Overview of Semiannual Reports of Medical Device Enterprises on the New Third Board

1.1 The overall scale of the enterprise is relatively small

According to incomplete statistics, there are 189 medical device related enterprises on the New Third Board. According to the disclosed 2017 semi annual report, except for 4 enterprises that did not disclose semi annual report data due to IPO and other factors, the remaining 185 enterprises achieved a total operating income of 6.535 billion yuan, with an average operating income of 35.3252 million yuan. There are 12 enterprises with revenue exceeding 100 million yuan, 19 enterprises between 60 million and 100 million yuan, 39 enterprises with revenue between 30 million and 60 million yuan, and the remaining 62.2% of enterprises with revenue below 30 million yuan. The overall revenue scale of medical device enterprises on the New Third Board is relatively small, and the industry concentration is still low; But at the same time, there have also been a small number of larger enterprises with revenue exceeding 150 million, such as Linhua Medical, Xinhong Medical, Darui Biological, etc.

1.2 Representative enterprises on the New Third Board have stronger growth potential

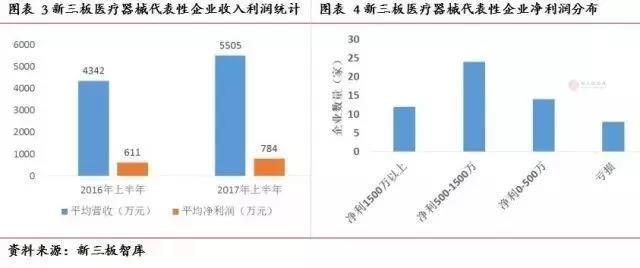

We believe that companies with revenue ranging from 30 million to 100 million have broken through the business exploration and trial period in terms of development stage, and are our key focus. There are 58 companies, and their performance is shown in the table below:

These 58 enterprises achieved an average revenue of 43.42 million yuan and 55.05 million yuan in 2016 and the first half of 2017, with a growth rate of 26.78%; The net profit was 6.11 million yuan and 7.84 million yuan respectively, with a growth rate of 28.31%. Among them, there are 3 companies with revenue growth rates exceeding 100%, 23 companies with 30% -100%, 28 companies with 0-30%, and 4 companies with decreased revenue; There are 11 companies with a growth rate of over 100% in net profit, 18 companies with a growth rate of 30% -100%, and a total of 11 companies with a growth rate of 0-30%. 18 companies have experienced a decline in net profit. Overall, there are 26 companies with revenue growth rates exceeding 30%, accounting for 45%; 29 companies with a net profit growth rate exceeding 30%, accounting for 50%, therefore half of the representative companies on the New Third Board are growing very fast.

Among the 58 enterprises, 12 have net profits exceeding 15 million, 24 have net profits between 5 million and 15 million, 14 have net profits between 0 and 5 million, and 8 have losses. From this perspective, companies with a net profit distribution of 5 to 15 million are the most concentrated.

From the perspective of these 24 enterprises (with revenue of 30-100 million and net profit of 5-15 million), the average revenue in 2017 was 52.94 million yuan, with a growth rate of 37%; The net profit was 8.7 million yuan, with a growth rate of 80%. There is one company with a revenue growth rate exceeding 100%, and there are 11 companies with a growth rate of 30% -100%. The growth rate of 11 companies is between 0% -30%, and only one company has a decline in revenue; There are 7 companies with a net profit growth rate exceeding 100%, 6 companies with a growth rate of 30% -100%, 6 companies with a growth rate between 0 and 30%, and 5 companies with a net profit decline. Overall, companies with revenue growth exceeding 30% account for 50%, while companies with net profit growth exceeding 30% account for 55%. More than half of the companies still have a faster growth rate. These enterprises also represent to some extent the growth status and future development trends of medical device enterprises on the New Third Board. Therefore, from this perspective, the New Third Board medical device companies showed strong growth momentum overall in the first half of 2017.

From the A-share, Hong Kong, and US stock markets, there are a total of 50 medical device companies with an average revenue of 700 million yuan and a net profit of 100 million yuan in the first half of 2017, according to incomplete statistics. The overall size is significantly larger than that of companies on the New Third Board. From the perspective of income distribution, there are 8 companies with incomes above 1 billion yuan, 30 companies with incomes between 200 to 1 billion yuan, and 12 companies with incomes below 200 million yuan. We believe that companies with revenue ranging from 200 to 1 billion can best represent the overall level of the entire market. The average revenue of 30 companies is 490 million yuan, with a growth rate of 24%; The net profit was 73.49 million yuan, with a growth rate of 12%. Among them, there are 10 companies with a growth rate of 30% -100% in revenue, accounting for one-third, 14 companies with a growth rate of 0-30%, and 6 companies with a decline in revenue; There are 11 companies with a growth rate of over 30% in net profit, accounting for about one-third of the total, 10 companies with a growth rate of 0-30%, and 9 companies with a decline in net profit. Therefore, from a growth perspective, the performance growth rate of medical device enterprises on the New Third Board is faster, and the proportion of growth oriented enterprises is higher.

1.3 Industry Classification

Before the analysis of the semi annual report, we divided medical devices into 15 categories, including IVD, cardiovascular related devices, orthopaedics, ophthalmology, imaging diagnosis, cosmetic surgery, injection puncture, endoscope and minimally invasive devices, dentistry, trauma management, kidney, gynecology and Urology, rehabilitation care, general surgery devices and sutures, and other categories. IVD, as a key sub field, also includes upstream raw materials, biochemical diagnosis, immune diagnosis, molecular diagnosis, microbial diagnosis, urine diagnosis, channel providers, etc. We have conducted a systematic and in-depth analysis of the semi annual reports in the above-mentioned fields.

There are a total of 66 companies engaged in in in vitro diagnosis business on the New Third Board, and 64 companies have disclosed their semi annual report data. In the first half of 2017, the overall operating revenue was 2.197 billion yuan, with an average operating revenue of 34.32 million yuan and an average revenue growth rate of 27%; The net profit was 169 million yuan, with an average net profit of 2.65 million yuan and an average growth rate of 102%.

2.1 New Third Board Companies in the Field of Biochemical Diagnosis Have Stronger Growth Potential

Overview of Semiannual Reports of Companies on the New Third Board, Main Board, and Hong Kong Stock Exchange

According to our statistics, there are a total of 12 biochemical diagnostic companies on the New Third Board, 6 on the main board, and 1 in Hong Kong stock market.

In terms of business development scale, 4 out of 12 companies on the New Third Board have revenue exceeding 50 million yuan, 6 out of 10 to 50 million yuan, and 2 companies have revenue less than 10 million yuan; There are 5 companies with net profits exceeding 3 million, 3 companies with 0 to 3 million, and 4 companies with losses.

From the 2017 semi annual report data, we believe that the New Third Board companies with revenue exceeding 30 million have certain volume value and are more worthy of tracking and attention. The main companies include Kangmei Biotechnology, New Health Cheng, Priber, Ipunokang, and Kefang Biotechnology. The average revenue of 5 companies is 58.49 million yuan, with a growth rate of 33%; The net profit was 11.52 million yuan, with a growth rate of 30%. From the distribution of performance growth rate, there are 3 companies with a growth rate exceeding 30%, accounting for 60%, and 2 companies with a growth rate of 0-30%; There are three companies with a growth rate of over 30% in net profit, one with a growth rate of 0-30%, and one with a decline in net profit, demonstrating strong overall growth momentum.

Although the overall revenue and net profit of the New Third Board are smaller than those of the main board companies, the performance growth rate is even faster, and the overall performance growth rate is faster than that of the larger main board companies. Among them, Priber, Ipunokang, and Kangmei Biotech performed the most outstanding in the first half of the year, with financial data as shown in the table below:

Comment on

The growth rate of biochemical diagnosis companies on the New Third Board is fast. Based on the above data, there are a large number of biochemical diagnostic companies on the New Third Board, although there is still a relatively small scale in terms of size. However, from the overall performance of the first half of 2017, it shows good growth potential. There are a total of 6 companies with revenue growth exceeding 30% on the New Third Board, accounting for 50%; There are 8 companies with a net profit growth rate exceeding 30%, accounting for 75%.

High costs drive rapid development. In addition to the performance comparison, we made a detailed comparison of the company's Gross margin and expense rate. From the results, the Gross margin of 12 companies on the New Third Board was about 56%, and that of 7 companies on the main board of Hong Kong stocks was about 55%, which was not different. From the comparison of sales expense rates, the average sales expense rate of New Third Board companies reached 28.23%, while that of Main Board companies was 14.01%. Therefore, the overall investment of the New Third Board Company in academic promotion, brand promotion, channel expansion and maintenance is significant, which is conducive to the rapid growth of the company.

The overall technical barriers in the biochemical reagent industry are relatively low, and currently 70% of the biochemical diagnosis market is open systems, which means that biochemical analyzers and supporting testing reagents are not the same brand. The main reason is that open systems often have lower overall procurement costs and enhance the profitability of hospitals. From the perspective of downstream customers, Grade A hospitals generally adopt Closed system procurement, while small hospitals or grass-roots hospitals are sensitive to price and cost, and tend to prefer open systems. The New Third Board Biochemical Diagnosis Company still focuses on the research and production of biochemical reagents, and some enterprises have achieved independent research and development of biochemical instruments, with profits mainly relying on reagents. Due to relatively low industry barriers, channel sinking, promotion, and brand promotion are more important. Given the high overall channel and sales investment of the New Third Board company, the overall performance is impressive.

2.2 Molecular Diagnosis New Third Board is Overall in a Rapid Growth Period

Significant unique advantages in the field of gene chips

Overview of Semiannual Reports of Companies on the New Third Board, Main Board, and Hong Kong Stock Exchange

There are many companies engaged in molecular diagnosis on the New Third Board, with a total of 21 companies, making it the most concentrated subdivision of in vitro diagnosis among the New Third Board companies. According to statistical calculations, the average income in the first half of 2017 was 37.76 million yuan, compared to 27.1 million yuan in the same period last year, with a growth rate of nearly 40%. From the perspective of net profit, the average net profit of the New Third Board Company was -10.9 million yuan last year, compared to 840000 yuan this year, with a growth rate of 177.35%. In terms of volume, we pay more attention to companies with a net profit of over 5 million yuan, with a total of 4 companies, namely Zhijiang Biotech, Saileqi, Darui Biotech, and Baiao Technology. The average revenue of the four companies is 86.88 million yuan, with a growth rate of 18%; The net profit was 15.5 million yuan, with a growth rate of 22%. Among them, 3 companies have a revenue growth rate of over 30%, accounting for 75%, and 1 company has a revenue range of 0-30%; 1 company with a net profit growth rate exceeding 30%, and 3 companies with a net profit growth rate of 0-30%.

There are also a relatively large number of companies engaged in molecular diagnosis business on the motherboard, including 9 companies such as Berry Gene, Daan Gene, BGI, and Adelaide Biology. There is one Mingyuan Medicare Development in the Hong Kong market (not disclosed in the semi annual report). From the performance of the first half of the year, the revenue and net profit of the main board companies were significantly larger than those of the new third board companies, with an average revenue of around 400 million yuan, a growth rate of 11.75%; The average net profit exceeded 60 million yuan, with a growth rate of 11.42%.

分子诊断行业处于爆发期

Molecular diagnosis is a diagnostic technology that uses molecular biological methods to detect changes in the structure or expression level of Genetic material in patients. It is widely used in hepatitis, sexually transmitted diseases, lung infectious diseases, eugenics, genetic disease genes, tumors and other fields. The technologies applied in the field of Genetic testing mainly include Polymerase chain reaction (PCR), Fluorescence in situ hybridization (FISH), gene chip and gene sequencing.

In 2010, the domestic molecular diagnostic market size was only about 1 billion yuan, reaching 3 billion yuan in 2014. With market breakthroughs in fields such as non-invasive screening, the market size in 2015 was close to 5 billion yuan, accounting for about 16% of the entire in vitro diagnostic market, and the development speed is extremely fast. With the continuous development of clinical applications, the industry growth rate is expected to maintain over 25% for a long time. The rapid development of the industry has led to the rapid growth of enterprises, so the entire field of molecular diagnosis, especially the New Third Board companies, has demonstrated high-quality growth.

Significant advantages of companies in the field of gene chips on the New Third Board

There were four companies in the molecular diagnosis field of the New Third Board with a net profit of over 5 million yuan in the first half of 2017, namely Zhijiang Biotech, Saileqi, Darui Biotech, and Baiao Technology. Their main business and financial performance are shown in the table below.

Comment

The molecular diagnosis industry will continue to experience explosive growth in the future. Although the overall revenue and net profit of the New Third Board companies are relatively small, they have strong growth potential and have emerged as a group of companies with a certain scale. The field of gene chips is a unique feature of the New Third Board Company, represented by Celoqi and Baiao Technology. In the first half of 2017, the performance growth rate was very fast, and in recent years, both have maintained strong growth momentum. The entire industry of gene chips is in a period of rapid growth in China, with great explosive potential. Although the market capacity is not as large as PCR and gene sequencing, the growth rate is very fast. In recent years, it has rapidly achieved a leap from scientific research to clinical practice, and there is great room for development in fields such as personalized medication. As an emerging technology and product application, there are currently no listed companies that focus on the gene chip business. Seleqi and Baiao Technology have achieved rapid development on the domestic gene chip market. Despite the current decrease in second-generation sequencing prices, the overlap between the application of gene chips and sequencing technologies is becoming increasingly high. Gene chip technology is gradually being replaced by second-generation sequencing in some fields, but chips have their own advantages: including relatively mature technology, simpler and faster sample processing and data analysis compared to sequencing, and significant advantages in rapid screening. In the future, we continue to look forward to the rapid development of related industries.

The overall size of the main board company is relatively large, with an average growth rate of revenue and profit of around 10%, which is relatively stable. Among them, Aide Biology and BGI Gene have performed well in their semi annual reports, and the main board companies in the field of gene sequencing services have shown strong competitiveness, especially in the field of non-invasive screening, including BGI Gene and Berry Gene with strong market dominance. There is still a lot of room for development in the field of molecular diagnosis in the future, and it will continue to be optimistic.

2.3 Significant localization trend of upstream raw materials

The upstream industry of in vitro diagnostic reagents mainly includes various bioactive substances such as enzymes, antigens, and antibodies. The proportion of raw materials in the cost of reagents is relatively high, with diagnostic enzymes accounting for about 60% of the cost in enzyme in vitro biochemical diagnostic reagents. The core raw materials of in vitro diagnostic reagents belong to a knowledge intensive and multidisciplinary industry. The research and development field has high technological content, long development cycle, complex production technology, high innovation difficulty, and strict quality requirements. In the past few years, in vitro diagnostic raw materials in China have basically relied on imports. The main reason is that diagnostic reagents have high requirements on the purity and stability of raw materials. Due to the limitations of technology and process, the quality of domestic raw materials still lags behind that of imports. Therefore, they are mainly purchased from abroad, and their Bargaining power is relatively weak.

With the gradual improvement of domestic basic research level and process level, domestic enterprises are also gradually extending to the upstream industry, realizing Import substitution industrialization by virtue of price advantage, and improving cost control capability. Some diagnostic reagent manufacturers, such as Lidman, Meikang Biology, Kehua Biology, have realized the expansion to the upstream.

2.4 Continuously focusing on areas such as immune diagnosis and POCT

We have conducted semi annual report analysis and statistics on fields such as immune diagnosis, POCT, third-party medical laboratories, and IVD channel providers. Based on the performance of the first half of 2017, the overall growth rate of the New Third Board companies is average, but there are also some highlights. Some companies have developed rapidly, including Microorganisms in the POCT field.

作为IVD领域市场容量较大,增速较快的免疫诊断、POCT领域,我们会持续关注行业的动态发展以及新三板公司的业绩未来表现。

The medical equipment in the field of cosmetic surgery includes various types of laser medical equipment and beauty instruments. There are three companies engaged in the research and development and production of related products on the New Third Board, namely Keying Laser, Qizhi Laser, and Yage Optoelectronics. The performance summary for the first half of 2017 is as follows. There are no listed companies in the A-share market that focus on this field, reflecting the unique advantages of the New Third Board in this field.

From the semi annual reports disclosed by three companies in 2017, the performance of the entire sector was very impressive, with an average revenue of 46.19 million yuan, a growth rate of 22.23% compared to 2016; From a net profit perspective, the average net profits of the three companies in 2016 and the first half of 2017 were 7.79 million yuan and 13.12 million yuan, respectively, with an increase of 68.5%. Among them, 1 company has a revenue growth rate of over 30%, and 2 companies have a revenue growth rate of 0-30%; The net profit growth rate of all three companies exceeds 30%, indicating strong growth potential. In addition, the profitability of the whole industry is strong, with Gross margin exceeding 50% and net profit margin exceeding 24%. From the perspective of net cash flow generated from operating activities, the three companies have abundant cash flow and strong operational capabilities, which is conducive to the long-term stable development of the company.

点评

Aesthetic medicine equipment and instruments, as the special field of NEEQ, saw strong performance growth in 2017. From the perspective of the industry, Aesthetic medicine has continued to develop rapidly in recent years. Benefiting from the gradual increase of people's demand for beauty and the continuous strengthening of their willingness to spend, downstream Aesthetic medicine service institutions have expanded rapidly, the demand for Aesthetic medicine equipment has increased significantly, and the market capacity has expanded rapidly. Therefore, in recent years, the Aesthetic medicine equipment company has developed rapidly. From the performance of the half year of 2017, the overall revenue and profit scale, profitability, cash flow and other aspects highlight the high-quality attributes of the industry, and Qizhi Laser has carried out coaching and filing. The future development prospects of the entire industry are bright, and we are optimistic about the future performance of this sector.

The medical devices in the field of trauma repair mainly include various medical dressings, biologically regenerated materials, etc. There are many companies engaged in related businesses on the New Third Board, with a total of 11 companies, 3 companies in the A-share market, 1 company in the Hong Kong stock market, and 1 company queuing for IPO. Among them, A-share Nanwei Co., Ltd., Hong Kong stock Puhua, and Shunhe Queued for IPO of Robust Medical did not disclose their semi annual reports, so the statistical data comes from the remaining 13 companies.

From the performance of each company's 2017 semi annual report, the performance differentiation of the 11 companies on the New Third Board is relatively severe. In terms of scale, we pay more attention to the development and growth of large-scale enterprises with revenue of over 20 million yuan, including four companies: Yuanxing Pharmaceutical, Ruiji Biology, Taibao Medical, and Chuanger Biology. The average revenue of the four companies is 42.21 million yuan, with a growth rate of 63%; The net profit was 11.17 million yuan, with a growth rate of 43%. Among them, four companies have revenue growth rates exceeding 30%, and three companies have net profit growth rates exceeding 30%, resulting in extremely fast performance growth.

The average revenue of the two A-share companies is 140 million, with a growth rate of 59%; The net profit was 22.55 million yuan, with a growth rate of 34%. The overall growth of the trauma repair field in the entire market is good, and it is currently in a stage of rapid outbreak.

Comment

The overall market capacity of medical devices in the field of wound repair is relatively large, and the rapid development of the industry is related to the aging population, the demand for health care, and the continuous improvement of medical expenditure level. Due to the fact that the market space for individual products is often only a few hundred million yuan, it is particularly crucial for enterprises to rapidly expand channels, increase market share, and continuously promote the research and development of new products. The main reason for the excellent performance of representative companies on the New Third Board, including Yuanxing Pharmaceutical, Taibao Medical, and Ruiji Biological, in the first half of 2017 is that they have achieved rapid expansion of existing product channels and significantly increased market share; In addition, each company has new product promotion and reserves, with strong growth potential.

The profit attributes of the New Third Board companies in the field of wound repair are basically similar to those of A-share Guanhao Biotechnology and Zhenghai Biotechnology. The leading renewable material company, Guanhao Biotechnology, had a revenue of about 200 million in the first half of 2017 and a net profit of about 24 million. In terms of net profit volume, the gap between the New Third Board companies is not significant, and there is still a lot of development space in the future. Although the overall performance of the sector is severely differentiated, the highlights are prominent, and high-quality enterprises are rising rapidly, which is worthy of special attention. We believe that the rapid growth period of large-scale enterprises in the entire trauma repair sector has fully arrived.

The field of rehabilitation nursing includes various medical and household rehabilitation nursing, monitoring equipment and instruments. There are a total of 18 companies engaged in related businesses in this field on the New Third Board, and three typical companies in the A-share market include Yuyue Medical, Jiu'an Medical, and Lexin Medical.

From the overall financial data, the average revenue of the New Third Board Company in the first half of 2017 was 38.9 million yuan, with a net profit of 3.92 million yuan; The average revenue of A-share companies is 360 million yuan, with a net profit of 120 million yuan. In the first half of the new third board, there were 6 enterprises with incomes above 50 million yuan, 10 enterprises with incomes between 10 and 50 million yuan, and 2 enterprises with incomes below 10 million yuan; There are 8 companies with a net profit of over 3 million, 8 companies with a net profit of 0-3 million, and 2 companies with losses.

From a growth perspective, there are 6 companies with a revenue growth rate of over 30% on the New Third Board, 9 companies with a growth rate of 0-30%, and 3 companies with a revenue decline; There are 11 companies with a growth rate of over 30% in net profit, 3 companies with a growth rate of 0-30%, and 4 companies with a decline in net profit. Two A-share companies have revenue growth rates exceeding 30%, and one company has a revenue growth rate of 0-30%; Two companies experienced a decrease in net profit and losses, with only Yuyue Medical achieving a 24% increase. From the perspective of Gross margin, the average Gross margin of the 18 companies on the New Third Board reached 44.11%, and the net operating cash flow was -370000 yuan; The average Gross margin of A-share companies was 33.43%, and the net operating cash flow was -5.2 million yuan.

There are a total of 8 relatively large companies in the rehabilitation nursing field (with a net profit of over 3 million yuan), and the financial data for the first half of the year is shown in the table below:

The average revenue of these 8 companies in the first half of 2016 was 47.16 million yuan, and the revenue in 2017 was 56.47 million yuan, with a growth rate of 20%; The average net profit in 2016 was 4.6 million yuan, reaching 7.76 million yuan in 2017, with a growth rate of nearly 70%. Among them, there were 3 companies with revenue growth exceeding 30%, 4 companies with 0-30%, and 1 company with revenue decline; There are 6 companies with a growth rate of over 30% in net profit, 1 company with a growth rate of 0-30%, and 1 company with a decline in net profit, demonstrating high overall growth potential.

Comment

There are many companies in the rehabilitation and nursing field of the New Third Board, and the overall scale is still relatively small compared to listed companies, in the stage of growth and upward trend. From the perspective of relatively large enterprises, in the first half of 2017, the performance grew rapidly, with revenue growth of 20% and net profit growth of 70%. The overall Gross margin of the enterprises increased significantly, thus driving the net profit growth to be significantly greater than the revenue growth. On the one hand, some companies extend their products to household use, improving Bargaining power and overall Gross margin; On the one hand, the investment in research and development, as well as the gradual promotion of the market, drive the sales of new products. Often, the high gross profit of new products drives the overall profitability of the company.

The field of rehabilitation nursing equipment has benefited from the acceleration of population aging, policy support, strengthening of national health awareness, and the improvement of family medical consumption capacity. The industry has developed rapidly. The overall development model and sales strategy of the New Third Board enterprises are relatively flexible, benefiting from the high prosperity and growth of the industry, and the overall performance maintains a relatively high growth rate. With the rapid expansion of channels and the gradual promotion of new products, the future growth prospects of large-scale companies are still bright.

Other fields of medical devices include cardiovascular, orthopedics, ophthalmology, imaging diagnosis, medication, endoscopy and minimally invasive instruments, dentistry, kidney dialysis, and other sub industries. From a comprehensive analysis, most of the companies are still in a relatively small scale and volume stage, with listed companies occupying a relatively large market share. The unique advantages of the New Third Board companies are not very obvious, and the overall growth rate is average.

Taking companies in the cardiovascular field as an example, there are a total of 14 companies on the New Third Board. Except for Kangtai Medical, which has not disclosed its semi annual report data, all 13 companies have disclosed their performance. The performance of cardiac monitoring and diagnostic medical equipment is average, while the performance of two companies in the stent field is good, including Yinyi Biological and Meizhong Shuanghe. Meizhong Shuanghe has a revenue of 135 million yuan, a growth rate of 16%, and a net profit of 12.4 million yuan, a growth rate of 290%; Yinyi Biotech's revenue exceeded 60 million yuan, with a growth rate of 5%, and its net profit was 11.43 million yuan, with a growth rate of nearly 30%. However, compared with A-share Lepu Medical, Hong Kong stock company MicroPort and Xianjian Technology, its size and growth rate still did not dominate, and the dominant position of the strong was still maintained. However, from an industry perspective, the future development prospects of PCI are still bright, and the New Third Board bracket business company still has high growth momentum in the future.

As a golden department in ophthalmology, the market capacity of ophthalmic related instruments and equipment will continue to steadily increase in the future. Although the overall sector effect is not prominent, Yide Medical and New Vision Company's performance will still maintain high growth.

Endoscopy and minimally invasive instruments, as the characteristic business areas of the New Third Board, cover 6 companies on the New Third Board, with Haitai Xinguang performing the most prominently. From the current time node, high-quality companies in the endoscope and minimally invasive device industry have achieved rapid growth, and the leading investment value is prominent.

Injection puncture instruments and consumables include infusion sets, syringes, intravenous indwelling needles, and puncture products. As a consumable and on-demand product, the market capacity of injection puncture instruments is large. A group of high-quality companies have also emerged in the field of the New Third Board, with a rapid growth rate and a large volume, including Zhejiang Fu Medical, Linhua Medical, and Tiankang Medical. The field of injection puncture instruments has strong customer stickiness and important brand reputation, and the advantages of leading companies will become increasingly apparent. In the future, we will continue to pay attention to the performance of this section.

About us

Company Profile Honor Typical Case Corporate imageEquipment display

Powder forming class Medical devices Non standard customized equipmentNews Center

Company News Industry News FAQContact us

TEL: +86 0769-82263072 Contacts: +86 139 2924 7077/Mr. Wei Email: 13929247077@139.com Address: No. 31, Hulin Road, Huaide Community,Focus on us

YeJet Mobile Station

YeJet Mobile Station WeChat official account

WeChat official account